A number of people have asked us for learnings from our house-building experience. We shared some of our experiences on a Te Karere news segment in February 2016. In addition to those comments we’d also add the following:

- LOCATION: Makarika (10km south of Ruatoria, 120km north of Gisborne)

- ORIGINAL BUDGET: $240,000

- TOTAL BUILD COST: approx. $290,000 (including plans, consents, lawyer, geotech, build, utilities, painting, flooring, blinds, fence, etc.)

- HOUSE VALUE: $219,000 (for removal upon completion)

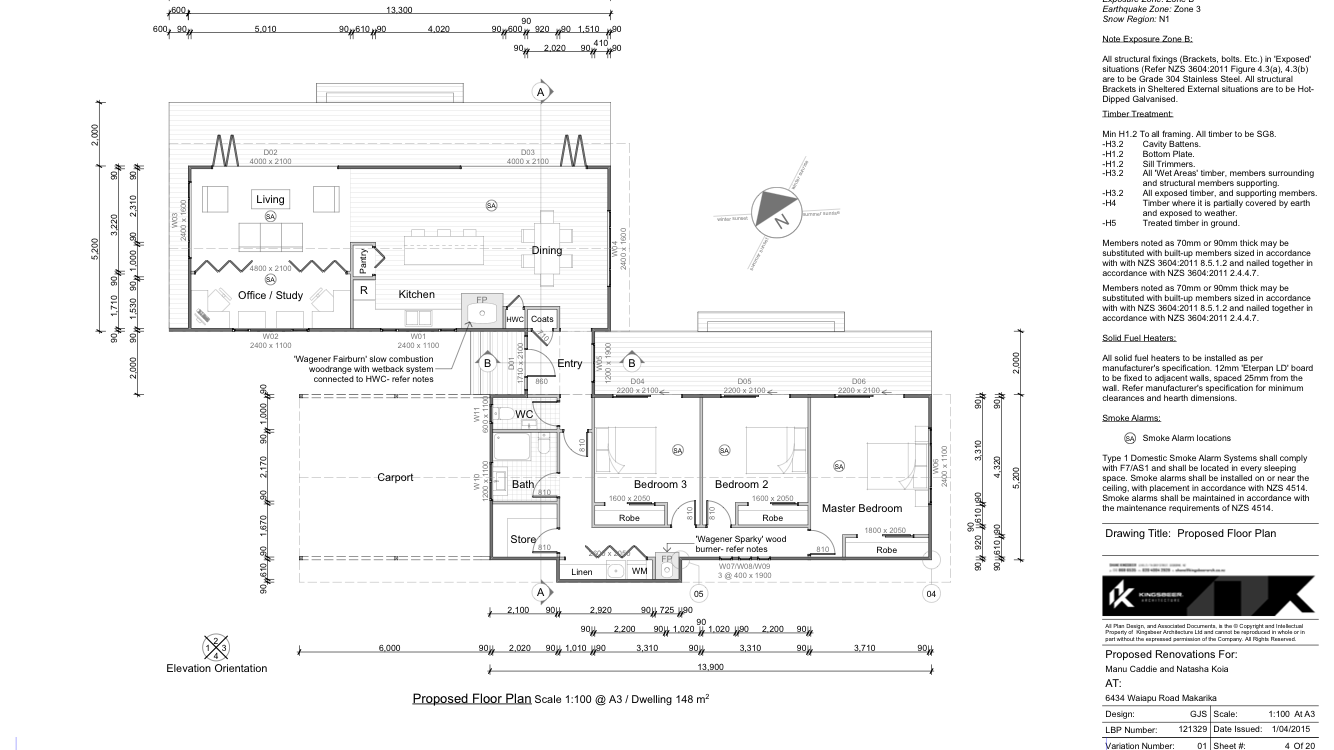

- ARCHITECTURAL DESIGNER COST: approx. $5,000 (totally recommend Shane Kingsbeer, Gisborne)

- CONSENTS COST: approx. $5,500

- LAWYERS COST: approx. $1,000

- GEOTECH COST: approx. $3,500

- It’s a lot of confusion and frustration – but ultimately worth persevering!

- Start planning and getting things happening at least two years before you want to be living in your new home. Everything takes at least twice as long as you think it should.

- Think collectively rather than individually. If possible, contribute to the whenua/marae years before you want to live there. Be prepared to submit yourself to the extended whānau with humility and

- Be respectful but also assertive with all the people you need to deal with (land owners, leasees, land administrators, court officials, etc.).

- Use experts – architects/designers (and/or resource/building consents advisors), rural plumbers are worth paying for, it saves more money later.

- No point getting permission to build somewhere you can’t. Before finalising the preferred location to take to shareholders for their consent, check out:

- how much it will cost to get electricity to the site (unless you’re going off-grid, then get a quote for that set-up)

- how much it will cost to build any roads/driveway and are consents required

- septic systems and whether they are permitted at the location

- geotech to tell you if you’re allowed to build on the proposed site.

MULTIPLY-OWNED MĀORI LAND

- Find out how the block you want to build on is being managed – is it under Te Tumu Paeroa or whānau shareholders as responsible trustees?

- Check what the deed governing the block says about leases – make sure it allows for leases for the term you need a mortgage for. Our block only allowed for a maximum of 10 year leases and we needed a 25 year mortgage – so had to seek shareholder support and then take it to the Māori Land Court to decide on a change to the deed. This delayed our build by 2-3 months, which could have been dealt with before we started.

- Get to know the responsible trustees (which may be Te Tumu Paeroa staff), explain what you’d like to do and see how willing they are to support you. Without their support it’s going to be a real struggle.

- Prepare a letter to shareholders with an explanation of who you are (how does your whānau whakapapa to the whenua, what connections have your tupuna/whānau had with the block/rohe/marae/hapū) what you want to do (including a draft plan and location on the whenua) and why you want to move there.

- We went with a 30 year lease, though it has to be reviewed every ten years. We pay a lease fee to Te Tumu Paeroa every six months. While our part of the block is only about 1/250th of the property area, we pay 1/15th of the total lease payment – which is fair enough, if we only paid 1/250th of the total lease it would only be $60/year for the privilege of living on the whenua.

TE TUMU PAEROA – THE NEW MĀORI TRUSTEE

- If Te Tumu Paeroa manage the land, they will have shareholders addresses and post your letter with a response form for shareholders to say if they support or oppose your proposal and why, or if they have any questions or conditions.

- If you have any issues with Te Tumu Paeroa taking too long, just email the CEO directly: jamie.tuuta@tetumupaeroa.co.nz – and he’ll get his people moving.

- For some strange reason there are two main teams in Te Tumu Paeroa regional offices – one that looks after shareholders, one that looks after leasees – and it seems that while they sit in the same office, members of the two teams often have to communicate through managers that are based in Wellington or somewhere else. Go figure.

KIWIBANK & HOUSING NZ

- The Kainga Whenua scheme relies on a tri-partite agreement between the bank, Housing NZ and responsible trustee/s – in our case Te Tumu Paeroa. Our experience was that these three organisations didn’t seem to have much knowledge of how this should work, it took weeks to finalise, which caused us more delays. With only nine mortgages being issued in six years, it’s no wonder they don’t have much understanding of their processes – but hopefully that is improving.

- Kiwibank didn’t tell us we’d need to change the land deed until after we’d had the loan provisionally approved and got the builder to start. So then we had to stop for a couple of months sorting out the deed via shareholders, Te Tumu Paeroa and the Māori Land Court. If they’d told us six months earlier when we first approached them we could have sorted it out much sooner.

- Housing NZ were pretty useless at communicating. It was hard to find who was responsible for dealing with our application. Just another faceless bureaucracy unfortunately.

- Kiwibank will only make payments on invoices from the builder based on the Building Agreement signed before starting. We had a generous builder who let us just pay the building supplies directly, so this meant some work around as the builder had to include all the expenses in his invoice and in theory paid the Council for consents, valuers, architects, etc.

FINANCE

We needed 20% deposit, that we had to show was spent before Kiwibank would allow any drawdown of mortgage funds.

We needed 20% deposit, that we had to show was spent before Kiwibank would allow any drawdown of mortgage funds.- Building on Māori land – maybe any new build – requires registered valuations before building and every time you want some funds to pay for each stage. Some people get a new valuation every three weeks so they can pay they tradespeople and suppliers. We restricted ours to five valuations over the nine(!) months of building because we are over 100km from the nearest registered valuer and it costs $600-800 for each valuation. In the big cities it’s only $250-300 for a progress valuation.

- Over the nine months (especially toward the end), we had to rely on whānau and friends to provide us with bridging finance of up to $60,000 – that meant we had cash when we needed it to pay tradespeople and reduced costs by needing less progress valuations.

Anything we’ve missed? Ask questions or add comments and we’ll attempt to respond.

Leave a reply to Chelc Tahau Cancel reply